Introduction

Not all debtors are the same. While some can pay on time without difficulty, others may face temporary cash flow problems or require extended payment periods. Recognizing this, businesses must adopt flexible payment plans and strategic collection methods to improve receivables management. At ARS Consultancy, a professional collection agency, we emphasize that flexibility combined with strategic planning enhances collection success while maintaining positive customer relationships.

Benefits of Payment Plans

Offer Solutions Suited to the Debtor’s Capacity

Flexible payment plans allow businesses to tailor solutions to each debtor’s financial situation. By providing manageable options, companies increase the likelihood of timely payments and reduce the risk of defaults.

Reduce Tension During the Collection Process

Debt collection can be stressful for both parties. A structured and considerate payment plan reduces tension, creating a cooperative environment where debtors feel supported rather than pressured.

Make the Payment Process Predictable

Formalized payment plans provide clarity and predictability. Businesses can better forecast cash flow, and debtors understand exactly when and how to make payments.

Strategic Collection Methods

1. Installments and Flexible Terms

Offering installment options or flexible deadlines accommodates the debtor’s financial situation, making collections smoother and more effective.

2. Discounts and Incentives

Early payment discounts, loyalty incentives, or additional benefits encourage prompt payment. ARS Consultancy often helps businesses design such programs to motivate debtors without compromising profitability.

3. Proactive Communication

Regular follow-ups, pre-payment reminders, and personalized messages maintain engagement and reduce delays. Proactive communication demonstrates professionalism and commitment to customer care.

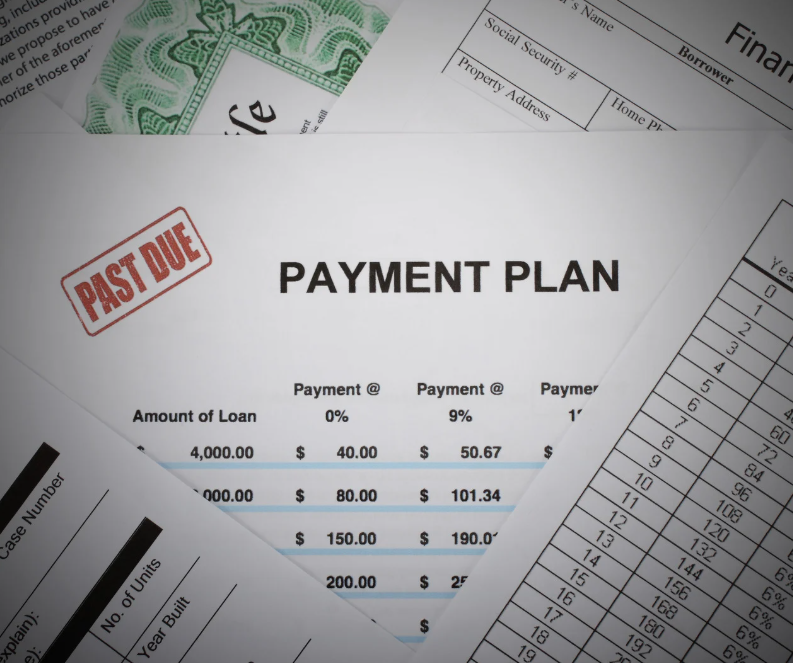

4. Document Payment Plans

Formal agreements ensure clarity and security for both debtor and creditor. Written plans minimize disputes and provide legal backing if issues arise, making the collection process more reliable.

Conclusion

Payment plans and strategic collection methods are essential for efficient and predictable receivables management. By combining flexibility, proactive communication, and clear agreements, businesses can improve collection performance while preserving strong, long-term relationships with their customers. At ARS Consultancy, we help clients implement structured payment strategies that balance efficiency, profitability, and customer satisfaction, ensuring that collections are both effective and respectful.